Are you aware about stamp duty calculation for purchasing immuvable property.

Hi guys,

Discussions are always better than arguments. Because an argument is to find out who is right and a discussion is to find what is right

Are you reading to me! Correct!

| Serial |

summary of Article

|

| 1. |

Introduction |

| 2. |

Where is the stamp duty to be paid on the instrument? |

| 3. |

Necessary basis for payment of stamp duty and registration fee in India |

| 4. |

Who pays stamp duty buyer or seller in India? |

| 5. |

Is stamp duty calculated on carpet area or built up area? |

| 6. |

How is stamp duty value of a property in India? |

| 7. |

Who is exempt from paying stamp duty? |

| 8. |

How I pay less stamp duty? |

| 9. |

Can I claim back stamp duty? |

| 10. |

How can we avoid stamp duty in India? |

| 11. |

What happens if you don’t pay stamp duty? |

| 12. |

References |

| 13. |

Conclusion |

-

Introduction

What a great fact. As the purchasing power of the people of India increases. People are seeing an increase in their wealth through their investments. As well as. Such property is immovable or movable property. Due to this stamp duty has become an important source of revenue for the government.

What a great type. Adhesive stamps are affixed on some documents. As much as. While sometimes non-judicial stamps are used on some documents. And. Stamp duty is a government tax under Section 3 of the Act.

What a great fact. The government has also enacted independent laws on stamp duty. As well as. And, independent government departments for compliance and regulation of stamp duty law. Please to be noted this.

What a great understanding. Anyone decides to buy a property. Then it is very necessary and inevitable to think about stamp duty. As well as. Neglecting stamp duty can also lead to financial loss. Based on the above discussion you may have realized the importance of stamp duty.

Here I am discussing important questions like this with you through this article. I hope you like my effort. And I will be involved in enhancing your legal understanding.

-

Where is the stamp duty to be paid on the instrument?

Stamp duty levied on the instrument shown below by purchasing at the rate fixed by the government. Please to be noted this.

| Affidavit |

Agreement |

Agreement to sell |

| Contract |

Bill of exchange |

Bond |

| Conveyance |

Instrument of Partition |

Lease |

| Security |

Mortgage deed |

Policy of Insurance |

| Legal document |

Power of attorney |

Promissory note |

| Settlement |

Receipt |

deed |

| Sale deed |

Release deed |

Share warrant |

| MOU |

Notaries documents |

Acknowledgement |

Necessary basis for payment of stamp duty and registration fee in India

- Deed of the sale in the name of the seller of the property

- Farmer Account Certificate

- Receipt of last 1 Years assessment tax paid by the person

- Registered development agreement of the property (in case of joint development property)

- Power of Attorney of the property

- The joint development agreement, GPA, and sharing/ supplementary agreement between any land owner and builder

- Copy of all previously registered agreements of the property (in case of resale property)

- Records of rights and tenancy corps or 7/12 extract

- Conversion order issued by the property authority

- The latest bank statement in case of any outstanding loan amount of the property

- Certificate of burden up to the current date of the property

- Property sale agreement

- Property electricity bill

- NOC from the seller's apartment association

- Approved building plan of the property

- Certificate of possession/possession from the builder regarding the property

- Title documents of any sold land owner

- Society shares certificate of property and photocopy of society registration certificate

Who pays stamp duty buyers or sellers in India?

Stamp duty is usually borne by both the buyer and the seller. As well as. But according to the practice, the person who is currently receiving the property through transfer, i.e. the buyer is paying full stem duty. Please to be noted this.

-

Is stamp duty calculated on the carpet area or built-up area?

What a great rule. And, the new RERA rules of stamp duty generally require a valuation of the property based on the area of the built-up area under construction. As well as. Previously, stamp duty was calculated on the basis of carpet area. To end this reason. But after the implementation of RERA, stump duty is calculated only on the basis of built-up area. Please to be noted this.

-

What is the stamp duty value of a property in India?

-

| Name of City/State |

Rate of Stamp Duty |

Name of City/State |

Rate of Stamp Duty |

| Bangalore |

2% to 3% |

Telangana |

5% |

| Delhi |

4% to 6% |

Rajasthan |

5% to 6% |

| Mumbai |

3% to 6% |

West Bengal |

7% to 8% |

| Chennai |

1% to 7% |

Uttar Pradesh |

7% |

| Kolkata |

3% to 5% |

Tamil Nadu |

7% |

| Gujarat |

4.9% |

Maharashtra |

5% |

| Kerala |

8% |

Uttarakhand |

5% |

| Andhra Pradesh |

5% |

Chhattisgarh |

Male- 7%Female-6% |

| Panjab |

7% |

Utarakhand |

5% |

| Hariyana |

Male- 7%Female-5% |

Madhya Pradesh |

9.5% |

| West Bengal |

Up to 40lacs 7%Above Rs.40lacs 8% |

Odisha |

Male- 5%Female-4% |

#. The rates of stamp duty mentioned here are for legal study and legal awareness. Please confirm and implement the stamp duty rates before registering the document.

How to calculate the market value of the property

The following method is followed to determine the market value of any property. The information presented here is intended to illustrate the calculation of market value only for you.

- District of the property: Surat

- Village of the property: Majura

- Property zone: 79

- Property sub-zone: 354

- Kind of property: Resident

- Age of property: 1 year

- Floor: Ground

- Area 500 Square fit carpet area

- Jantri rate: 88200=00

- 500 Square fit ( firstly you are converting Square fit into a built-up area)

500X 1.2=600 (Sq. fit ) built-up (Secondly you are converting a built-up into a Square meter area)

600X10.76= 55.762 a Square meter (Built-up)

Rate of Jantri (88200)X Area (55.762 a square meter)+ Market value 4918208.40 ( Round up Rs.4918200)

Valuation of property= 4918200/- Sale value of the property= 55,00,000/-

55,00,000X4.95(Rate of the stamp duty in Gujarat) =Rs.2,75000/-

- Registration fees are 1% of the property value. ( The government has declared exemption from payment of registration fee if the woman is the sole buyer of the property.)

Are you passionate about reading on Are courts fees payment refundable?

-

Who is exempt from paying stamp duty?

What a great exemption. To be eligible for a stamp duty rebate in India. As well as. Each taxpayer must be an individual owner, co-owner, or member of a Hindu undivided family who has purchased a residential property. To the end of this reason. In the case of such joint ownership, co-owners can avail of tax exemption up to Rupees 1.5 lakhs (per person). Please to be noted this.

-

How do I pay less stamp duty?

In India, stamp duty cannot be paid less. As well as. But if the property is purchased in the name of a single female member of the household. For that end reason. Exemption from payment of registration fee is required.

-

Can I claim back stamp duty?

What great tips. Stamp duty can only be refunded in cases where it has not been used for any reason. As much as, It is mandatory to apply to the Authorize officer of the Registration and stamp department at the district level within 6 months as per Section 2 (9), 48, 49, 50, 51, 52,52A, and 52B of the Act for recovery of stamp duty.

As well as. After the loan has been verified by the person, a certificate of stamp refund is issued and then the remaining amount is refunded to the applicant after deducting 10% of the total stamp amount purchased. Please to be noted this.

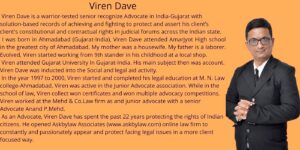

Viren Dave Viren Dave is a warrior-tested senior recognize Advocate in India-Gujarat with solution-based records of achieving and fighting to protect and assert his client’s client's constitutional and contractual rights in judicial forums across the

Can I challenge the collector's order in a suitable forum?

What a great rule. Under section-56 of the Stamp Act. As well as. If an applicant is dissatisfied with the order made by the authorized officer or the Collector. As much as. The applicant may revise or refer to the Chief Controlling Revenue Authority to reverse the decision of the Collector in the Higher Forum. To end of that reason. And, may make a revision or reference to the State High Court to reverse the decision of the Chief Controlling Revenue Authority under Section-57 of the act.

-

How can we avoid stamp duty in India?

What a great finding. Neglecting stamp duty is a futile idea. The document cannot be registered or executed without payment of stamp duty. And a document without stamp duty has no legal value in the eye of law. Please to be noted this.

-

What happens if you don’t pay stamp duty?

Stamp duty is payable before and on the day of execution of any document or on the next working day of execution of such document. As well as. And the execution of a document means that the instrument is signed and registered or executed by the person's party to the document.

Any delay in payment of stamp duty will drag up to 2% per month up to a maximum of 200% of the amount deficit of stamp duty. And stamp papers have to be purchased in the name of any of the parties involved in the agreement. So that the seller or buyer, who fails, will have the stamp paper deactivated. It is said to be valid for six months from the date of purchase only if the duty is paid on time. There is a high probability that the invalidation of the stamp will result in an error in the execution of the document.

The latest news 2022: You need to know the best stamp duty calculator

-

References

- The Indian stamp act-1899

- The Notaries act

- The Indian registration act

- List of inspector general of stamp duty and registration-Gujarat

-

Conclusion

What a great solution. I have discussed with you in detail the legal provisions for stamp duty above. As well as. Generally means that the person buying the property has to carefully implement the bubble of stamp duty. This means that if the person buying the property neglects to pay the stamp duty, he may face bad consequences.

So you can increase the legal value of your property by calculating the stamp duty and paying it.

To be noted. Any citizen of the world who needs legal guidance/advice will contact us. As well as. We will always be ready to provide them with free or paid initially legal advice and guidance.

Are you passionate about reading on Are decree absolute published? | 7 ways of 100% legal review of a word in the world.

Jay Hind Jay Bharat

“A smile can make short work of any difficulty”.

Have a good day