- Law Office Overview

- What About us-VIRA

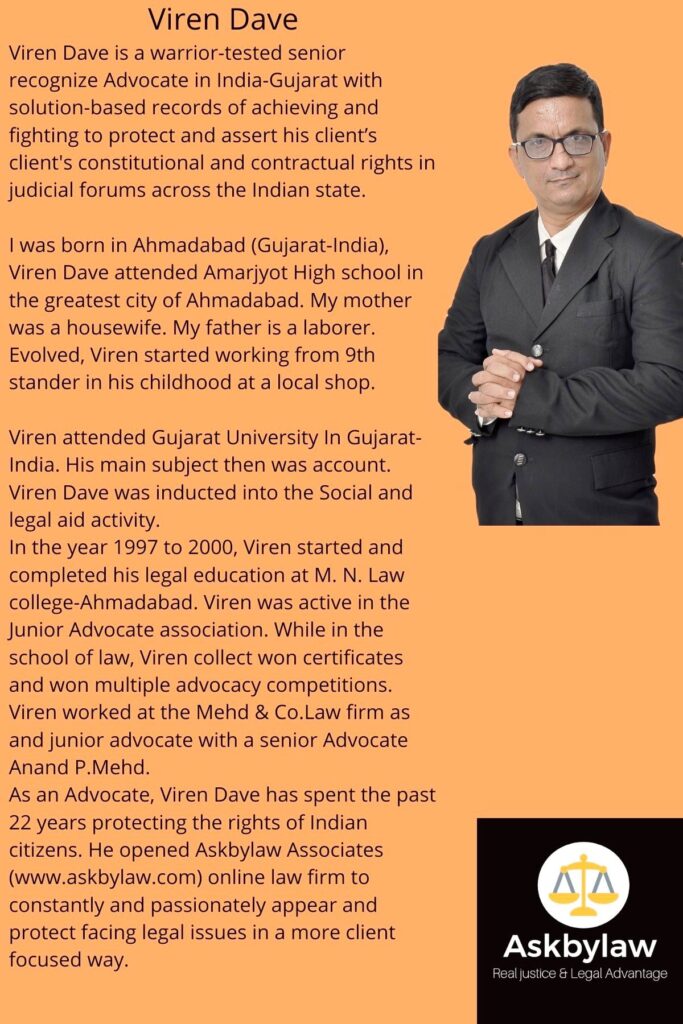

- About Us

- Practice Area—VIRA

- Practice Area

- Legal services-VIRA

- Legal Services

- Legal Consultation Services

- Legal Case Evaluation Service

- Legal Document Drafting, Registration & Review Service

- Litigation Services

- Alternative Dispute Resolution (ADR) Service

- Legal Settlement Negotiations Service

- Higher Forum Approach: Conviction or Compensation Relief

- Corporate Counsel & Compliance

- Tax Law Services

- Asset Protection & Wealth Management

- Insight legal blogs

- FAQ

- Consultation

- Vira Tool Info