Introduction

You like. Home Loan Law and Home Loan is an indispensable necessity for human beings. A home loan is often indispensable after the marriage ceremony of a person, buying a house is the basic dream and dream of every person. But due to a lack of sufficient knowledge, man has to face some unnecessary struggles in fulfilling this need.

Home loan law. Like how to get a loan? What to do to apply for a loan? Where are the documents to be submitted to get the loan? How is the loan installment determined? All these basic questions need to be answered before availing of a home loan.

You read it. It is better for every loan aspirant to get a loan by considering how he will repay it. Lending institutions check a person's credibility and score before granting a loan.

You like it. If a person gets a loan without planning how he will repay the loan installments, he may also get into financial trouble. And the lending institution can take possession of the hard-earned property and dispose of it in its own interest. As much as. That is why it is more important for everyone to plan how they will repay the loan before getting a loan. Because at any time in human life there are ups and downs.

Today I'm here to discuss with you in this article how to buy a house well. And. I hope you will like and find my discussion on buying a home loan useful today.

Consult your home loan law question-814.004.3411

Are you passionate to read this: https://askbylaw.com/Catagory/real-justice-by-gujarat-high-court-on-tax-refund/

What are the documents required for the loan process?

You like. Loans can be obtained in different ways as the needs of people are different. Such as salaried individuals, self-employed individuals, personal loans, business loans, vehicle loans, etc. As much as. Let us try to understand with the help of the table given below where the evidence has to be given to the lender to get such a loan.

For salaried person

|

For professional person |

For Personal

|

For Business person

|

Evidence of resident

|

Income tax return

|

Proof of identity

|

Pan card

|

Proof of Identity

|

Evidence of resident

|

Proof of resident

|

Adhar card

|

Bank statement/ Passbook

|

Proof of identity

|

Bank statement/ Passbook

|

Passport

|

Salary slip and form no. 16

|

Bank statement/ Passbook

|

Salary slip and form no. 16 ( Only employee)

|

Voter ID card

|

All documents of the property

|

License of Profession

|

Form no. 26A (only professional)

|

Driving license

|

Passport photograph

|

Single Passport photograph

|

Passport photograph

|

Income-tax return verified by CA

|

Pan card

|

Copy of Pan card

|

Pan card

|

Registration certificate of business

|

Cibil score

|

All documents of the property

|

Cibil score

|

Partner sheep deed- in case of partnership

|

|

|

Cibil score

|

|

Resolution- in case of company and trust

|

|

|

|

|

Memorandum of the articles-in case of the company

|

|

|

|

|

Articles of the association-in case of the company

|

Is legal opinion mandatory for a home loan?

Watch if you like. Every lending institution first wants to study the legal title and status of the property. As well as. On which the loan is to be made before extending the loan. Because it is only after the legal study that the lending institution decides, whether to mortgage the property or not. Please be noted.

You see first. That is why every lending institution appoints its own legal advisors. As well as. The legal advisors of the lending institution give a written opinion on whether the property is loanable. As much as. Which we also know as Legal Opinion. Please to be noted this.

As much as. It is your duty to ensure that your property is not adversely affected by any legal complications regarding the mortgage. Please to be noted this. Read more…

The legal side of the property

You like first. As you are not aware of the professional competence and reputation of reference of the property legal advisors appointed by the lending institutions. As well as. And so. It is advisable for you to hire a legal advisor to assess your personal property. As much as. The legal advisor you hire can study every corner of the property and give you factual information about the legal side of your property. Please to be noted this. Read more…

Title of the property

You like it. There are different laws regarding local construction and permits for building a property. As well as. Whether the holder of the property and the borrower can easily transfer the title of the property to the lender? As much as. The matter is investigated by the legal advisors of the lending institutions. Please to be noted this. Read more…

Tax effect of property

If we discuss Section 50C of the Indian Income Tax Act. As stated in it, the stamp duty amount can be increased if the stamp valuation of the property is higher than that stated in the agreement. As much as. If the stamp valuation is above 100% of the contract. As well as. It is treated as the income of the seller and buyer of the property. Please to be noted this.

Other related law effects of the property

You see. In order to get a loan. As well as. If the loan is done on the property by studying and planning the other laws related to the property like a transfer of property, gift, HUF law, Revenue code, Tenancy act, Town planning act, Succession act, etc. As much as. Then the property mortgagor does not face any legal problems. Please must be noted.

What are the documents required for legal opinion for a bank loan?

- Village form no. 7 and 12

- Village form no. 6 (Including all entries)

- Village form no. 8A

- Copy of Property card

- Zoning certificate

- Site plan

- DILR Plan

- NOC for no dues

- NA permission

- Permission of construction and building plan

- Contract of Construction

- Form-B of Town planning

- Property tax receipt

- Other documents

-

Real estate and home loan law

- Our law firm staff has years of experience in real estate practice. Together with builders and sureties, we work hard to guide people in planning and buying a home with ease. This is what our clients say. It has made them owners and occupiers of a house despite having less money to buy a house. So they are very satisfied with our home loan law services.

-

What happens if the home loan is not paid?

- If the home loan couple remains unpaid for 3 consecutive months due to personal reasons. The lending banker will issue a legal notice to them. And if the EMIs remain unpaid for more than 3 months, the banker will include such home loans in the category of NPA i.e. non-performing assets. Even then, if the home loan holder is unable to pay the EMI due to personal reasons. Such NPA property is confiscated as per the rules. As much as. The foreclosed NPA property is auctioned and the banker's amount is recovered from it. And the remaining excess amount, if any obtained in an auction, is returned to the home loan holder.If a loan holder's property is sold through a public auction, the loan holder's credit score and CIBIL score become weak due to which the loan holder may face difficulty in getting new loans in the future.

-

Reference

- IRS Guideline for a home loan

- Guideline of RBI regarding Home loan law

Conclusion

-

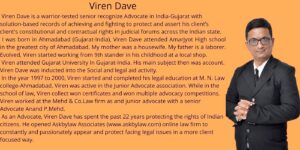

Viren Dave Viren Dave is a warrior-tested senior recognize Advocate in India-Gujarat with solution-based records of achieving and fighting to protect and assert his client’s client's constitutional and contractual rights in judicial forums across the conclusion

- Look you. Like it. What a great idea. Read it. That the Security of money lending is a vital and fundamental concern for any financial institution in any country. As well as. The security of money lent to people is the security taken against the financial facility being lent. As much as. And. so if there is any defect or error in the security accepted then the question of safety and recovery of the money lent arises. Please be noted.Home loan law. Look you. Like it. In security. As much as. And mainly should take care regarding verification of title and verification of possession and other law. Please be noted.Are you ready to start preparing to buy a home? That's when Homes for Heroes home loan law experts can save you hundreds of dollars or national currency. See our real estate agents can save you thousands of money. For every $100,000 or rupees in your home's value, you are noted our real estate experts will send you a 7% check after closing. This saves our law enforcement heroes $ 2,400 or covert national currency when using our real estate and mortgage experts. Talk to one of our real estate experts about buying a Home for Heroes mortgage to get you started on your home buying journey and save money along the way.Are you passionate to read this: Stamp duty calculation

-

Consult your home loan law question-814.004.3411

-