Have a good day folks, Children and tax table

Have you heard me! Correct! Children and tax table

“Start your day with A lovely smile”

You also read My husband sexually assaulted me: 3 proven ways 110% coming out from Big Dark spot of couple life

Introduction: Children and tax table

Each & every citizen is curious to know too the Budget.

Currently, the budget for the year-2022 has been announced by the Finance Minister of India. In addition, no major and important changes made in the budget for the FY-2022 regarding the Covid-19 epidemic.

The provision in budget tax is applicable on 01/04/2020. Applicable is in 2022as per my sense. Hard-working taxpayers are frustrated.

In the old tax structure, a person is dependent on an individual taxpayer according to his age and residence status. In that case, the basic waiver amount has kept at Rs. 2500000 as per the old provision.

Income tax table for 2022-23

| Old tax structure

(Include deduction

and

exemption) |

Total income

|

New

tax structure

(Include deduction and exemption) |

| Nil |

Up to Rupees 2.5 Lacs |

NIL |

| 5% |

From Rupees 250001 to Rs.5,00,000 lacs |

5% |

| 20% |

From Rupees 500001 to Rs.7,50,000 lacs |

10% |

| 20% |

From Rupees 750001 to Rs.10,00,000 lacs |

15% |

| 30% |

From Rupees 1000001 to Rs.12,50,000 lacs |

20% |

| 30% |

From Rupees 1250001 to Rs.15,00,000 lacs |

25% |

| 30% |

From Rupees 15,00,000 lacs and above |

30% |

Children and tax: Children and tax table

There are different ways to save money in which your family, parent, spouse or child can help you to save money in the form of tax obligations. The primary tax requirement for children is to “open a child savings account”. The maximum interest amount of a bank account opened for a minor is Rs. 1500. Up to two children are exempted under Section 10 (32) of the Income Tax Act.

Medical expense for the disabled children-child and taxes table

Your child has a disability from 40% to 60% due to a specific illness; a deduction of up to Rs.40, 000 for the actual expense of treatment of that child can obtain under Section-80DDB of the Income Tax Act.

The actual medical expense of treating a child is more than 80 percent disabled due to a specific illness of your child deduction up to Rs. 125,000. The said advantage is available under Section-80DDB of the Income Tax Act.

Investment of child-children and taxes table

If a taxpayer wants to invest in the name of his dependent child, you can invest up to Rs 150000 per annum as per Section 80C of the Income Tax Act. The said investment is fully exempt.

Tuition fee-child and taxes table

The taxpayer pays the tuition fee or school fee of the dependent child. That the said tuition and school fee exemption under section 80C of the Income-tax Act for an annual amount of 1, 50,000. And, you are a salaried taxpayer; you can claim 100 rupees per child and 300 education allowance every year.

Education loan-children and taxes table

You are taking a loan for a child's higher education; its compound interest is deductible under section 80E of the Income-tax Act.

Health insurance-children and taxes table

You are purchasing health insurance for your child; you get a deduction for the dependant and or disabled children's health insurance premium up to Rs. 25000 per annum. And health check-ups up to Rs. 5000. Wow, the said advantage under section 80D of the income tax act.

Gift-children and taxes table

You want to give a cash gift to your child; you can give less than Rs. 50,000. If you do not give more than that, the entire amount will be taxable.

You want to give an immovable property gift to your child; you can give less than Rs. 50,000. If you do not give more than that, the entire amount will be taxable.

Partnership and children-children and taxes table

Individual income to include income of spouse, minor child, etc.

All such income arising directly or indirectly shall be included in the calculation of the total income of any person-

(I) the spouse of such person, from the membership of the person who is running the business in the firm in which such person is a partner;

(ii) The benefits of participation in a firm in which such a person is a partner, from the entry of a minor to the minor child of such person;

(iii) Subject to the provisions of section (I) of section 27, the spouse of such person shall be directly or indirectly transferred from the assets to the spouse for otherwise sufficient consideration or in relation to the separation agreement;

(iv) a minor child, subject to the provisions of section (I) of section 27, from property transferred directly or indirectly by such person to a minor child, without adequate consideration, as he is not the married daughter of such person; And

(v) any person or persons 'association from the transferred property, except for adequate consideration of the person or persons' association by such person, to the extent that the income from such property is for his or her immediate or delayed benefit, to the extent that the spouse or minor child (not married daughter) or both.

Explanation.

For the purpose of section (I), the person whose total income in the calculation will be included in the income specified in that section will be the spouse whose total income (excluding the income specified in that section) is higher;

And, for the purpose of section (ii), where the parents are members of both generations in which the minor child is a partner, the income of the minor child from the partnership shall be included in the income of the parent whose total income (excluding the income specified in that section) is higher;

And where any such income is once included in the total income of the spouse or parent, no such income shall be included in the total income of the other spouse or parent in any subsequent year unless the income tax officer is satisfied to hear the spouse or parent. Given a chance, it is necessary to do so.

Divorce of spouses and child

For some inexplicable reason, husband and wife decide to divorce. This condition can be very painful for everyone. In such a situation, if both the spouses are taxpayers, the situation becomes more worrying.

Eligibility criteria of child tax credit

There is no minimum age for reimbursement of child education allowance in respect of the children enrolled in the nursery. However, a minimum age of 5 years has fix for physically handicapped or especially handicapped children, children with handicapped receiving non-formal or vocational education. However, as of February 21, 2012 (Notification- O.M. No.12011 / 07 (ii) / 2011-Est. (AL) dated-21.02.2012).The minimum age for children with disabilities has reduced to 5years. Therefore, there is no minimum age for which compensation is claimed for a child, regardless of whether the child is disabled or not.

Who gets to claim the child on taxes after divorce?

In the event that a taxpayer spouse decides to take custody of their child after the divorce, the taxpayer who has physical custody of the child may claim the tax credit of his / her child in the income tax return.

What happens if divorced parents both claim the child tax credit?

Generally, only one person can claim the head of household filing status, Child Tax Credit / Credit for Other Dependents, Dependent Care Credit / Exclusion for Dependent Care Benefits, Dependent Care Credit / Exclusion for Eligible Child. Dependent care for benefits and tax credit.

First thing

There is a special rule for parents or guardians who have been divorced or separated for the last 6 months of the calendar year. If the requirements of the special rule are satisfied, the child is considered as a child eligible for non-custodial parent for child tax credit/credit purposes for other dependents, whereas the custodial parent can claim dependent care credit and tax credit.

Second thing

Parents can claim an alternate tax credit each year only if they change the pattern of who has physical custody of the child each year. To become a taxpayer-eligible child for a tax credit, the child must pass a residency test. The special rule does not apply to tax credits for parents who are divorced or separated during the last 6 months of the calendar year or parents who are always separated.

Final idea

The wife can claim a tax credit only if she files a joint return with her husband and they meet all other eligibility requirements. Her permissible filing positions are jointly married filing or separately married filing. She is not eligible for a tax credit if she chooses to file separately

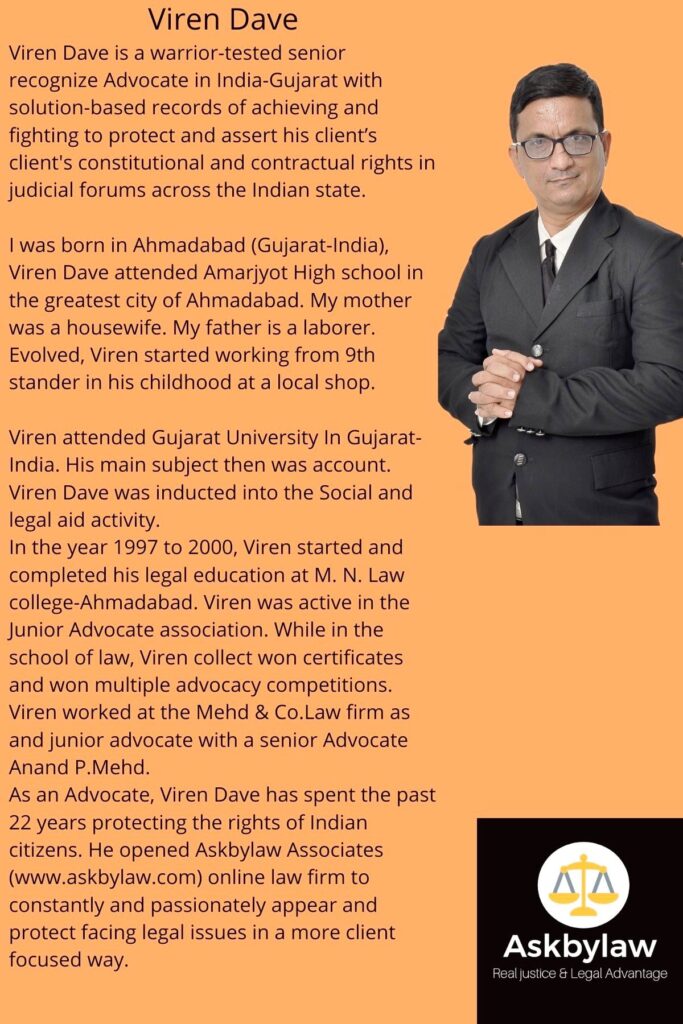

VIREN S.DAVE

Conclusion: Children and tax table

The issue of a tax credit of the child should also fix when the taxpayer couple decides to divorce. Doing so will prevent any future disputes over the tax credit.

If the issue of a child's tax credit is left unresolved. Give your family lawyer information and papers on how your family lawyer can help you get your child's tax credit.